Managing your money shouldn’t be harder than managing your clients’ workouts. But for many fitness professionals, balancing taxes, budgeting, and banking often feels like another full-time job.

That’s why we partnered with Found, the all-in-one banking, bookkeeping, and tax solution for the self-employed, to bring you an exclusive webinar on how to simplify your financial systems and avoid the most common mistakes fitness pros make.

If you missed it, don’t worry, we’ve got you covered. The full recording and slides are now available inside Everfit Academy.

Why Your Finances Deserve the Same Discipline as Your Training

When you help clients get stronger, you teach them to track progress, build good habits, and stay consistent. Your business finances work the same way.

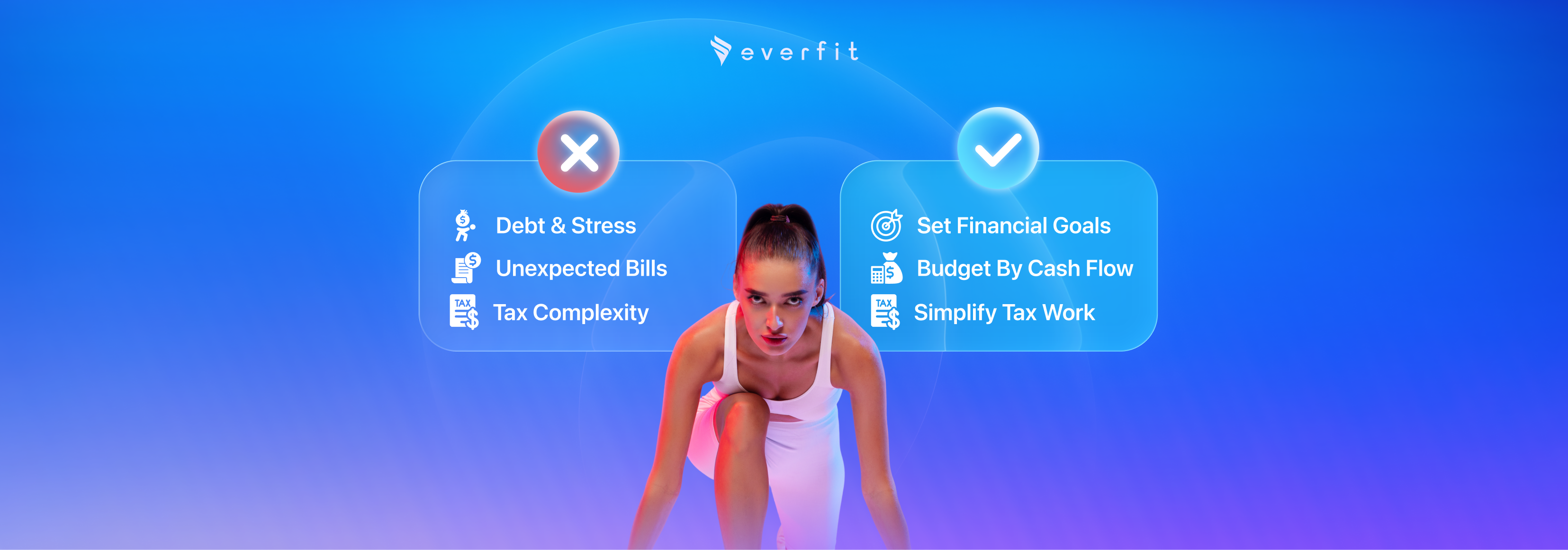

Without a strong financial strategy, it’s easy to undercharge, miss growth opportunities, and face stressful surprises at tax time. This webinar breaks down the most common mistakes fitness pros make and provides simple systems to help you avoid them, so you can spend less time stressing over spreadsheets and more time coaching.

Key Takeaways You’ll Learn in the Webinar

1. Set Financial Goals with Intention

Just as your clients need clear fitness goals, your business needs defined financial targets. When you intentionally track revenue, expenses, and savings, you avoid undercharging, build confidence in your pricing, and create a roadmap for growth and retirement planning.

2. Treat Financial Check-Ins Like Training Sessions

Consistency is everything. A regular review of your finances reduces stress, uncovers new opportunities, and helps you make smarter pricing and budgeting decisions. Think of it as holding yourself accountable the same way you hold your clients accountable in the gym.

3. Build a Budget Around Real Cash Flow

Income in the fitness industry often fluctuates with client schedules and seasons. Designing a budget that reflects these ups and downs allows you to prepare for slow periods, cover essential expenses, and pay yourself reliably without falling into unnecessary debt.

4. Approach Taxes as an Ongoing Strategy

Taxes aren’t a once-a-year headache; they are a year-round process. By planning quarterly payments and tracking deductible expenses as you go, you minimize surprises, reduce penalties, and ensure you’re keeping more of what you earn.

5. Stay Ahead of Paperwork

Delaying tax paperwork only creates chaos when deadlines hit. Organizing receipts, automating expense tracking, and preparing forms early gives you peace of mind and frees up valuable time to focus on clients instead of scrambling through documents.

Watch the Replay and grab the Slides

The full recording and slide deck are now available exclusively on Everfit Academy.

If you haven’t joined yet, Everfit Academy is free and open to everyone—not just Everfit users. You’ll get access to expert-led webinars, bite-sized courses, and downloadable tools to grow your coaching business.

Meet the Expert

Our presenter from Found works closely with platforms like Everfit to help self-employed professionals simplify money management. With Found, you can:

- Automate expense tracking

- Get accurate tax estimates

- Save for quarterly payments automatically

- Organize everything you need for filing in one place

📲 Learn more about Found:

- Web: https://found.com/everfit

- Instagram: @foundforbusiness

Special Bonus for Coaches

We’ve partnered with Found to offer an exclusive $200 bonus* to fitness professionals ready to take their finances to the next level.

👉 Get started with Found + unlock your $200 bonus

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.

To qualify for the $200 bonus, sign up with code EVERFIT and deposit $2,000 of earnings from Everfit into Found within 90 days of account creation. Offer valid for new customers and expires 12/31/26. Terms apply.

Ready to Streamline Your Coaching Business?

Everfit helps you manage clients, programs, check-ins, and payments, all in one place.